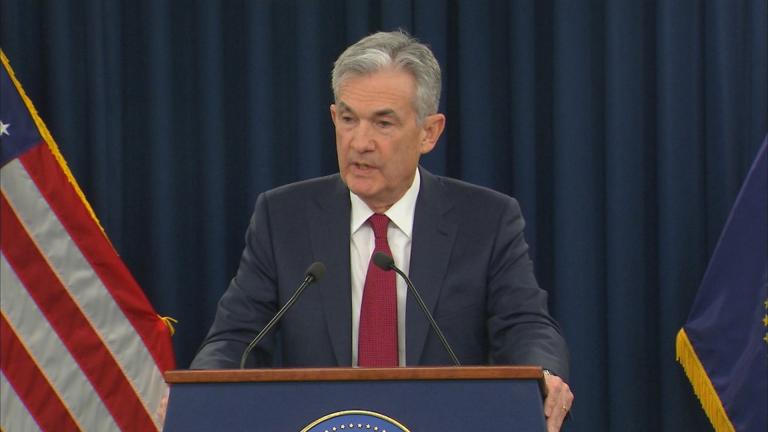

Federal Reserve Chair Jerome Powell warned Tuesday that a tentative recovery from the pandemic recession could falter unless the federal government supplies additional economic support.

Federal Reserve

Whether piled up in change jars, cup holders or couch crevices, coins are not circulating, and that makes it difficult for businesses to deal in cash, the U.S. Coin Task Force says. Here’s how to help.

A conversation with with the Nobel Prize-winning economist and New York Times opinion columnist about his new book, “Arguing With Zombies: Economics, Politics, and the Fight for a Better Future.”

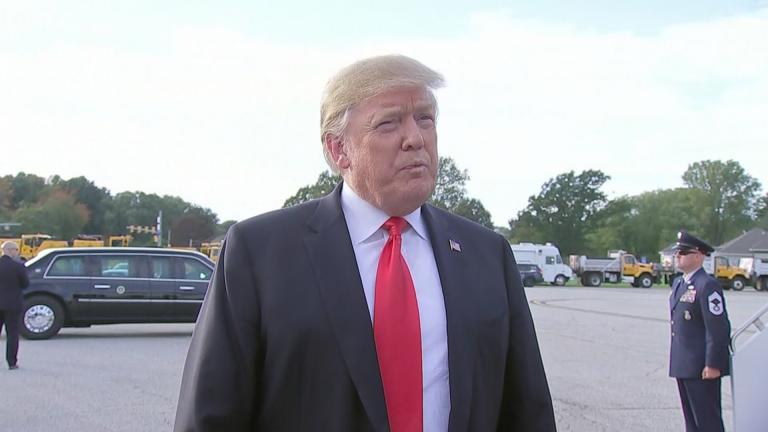

While the U.S. economy continues its record-breaking expansion, some wonder whether the Fed reacted to softening global markets or perhaps even pressure from President Donald Trump.

The Fed under Chairman Jerome Powell has signaled that rising economic pressures — notably from President Donald Trump’s trade wars and from a global slowdown — have become cause for concern. So has an inflation rate that remains chronically below the Fed’s target level.

Chairman Jerome Powell didn’t explicitly say what the Federal Reserve would do. But expectations are rising that the Fed will cut rates at least once and possibly two or more times before year’s end, in part because of the consequences of the trade war.

The Federal Reserve hikes its benchmark interest rate for the fourth time this year, by one-quarter of 1 percent to 2.5 percent. We discuss the outlook for the markets and the economy.

A market that has grown used to cheap money over the past decade is becoming increasingly concerned that the Federal Reserve will aggressively raise benchmark interest rates.

President Donald Trump is boasting a booming economy, but will higher interest rates stop it?

While Fed Chair Janet Yellen ends her tenure on an upbeat note, are there storm clouds ahead for the economy?

Median incomes in America are on the rise. What will be the response of a Federal Reserve Board with vacancies?

Another record-setting day on Wall Street. What’s propelling the stock surge—and can it last?

The Federal Reserve is expected to raise the benchmark interest rate again. What that means about the U.S. economy.

Last week’s rate hike is a sign of optimism over growth in the U.S. economy. But how will it impact borrowing, like mortgage and credit card rates?

Unemployment is down, the stock market is up and the Federal Reserve raises interest rates. Just how strong is the American economy? Two Chicago economists take stock of what’s in store for 2017.

Federal Reserve chief Janet Yellen rejects the notion that the Fed plays politics when deciding interest rate policy.