The 2019 law consolidated some 650 retirement funds for municipal public safety workers into two funds — one for firefighters and another for police officers. Chicago is not included.

Pension

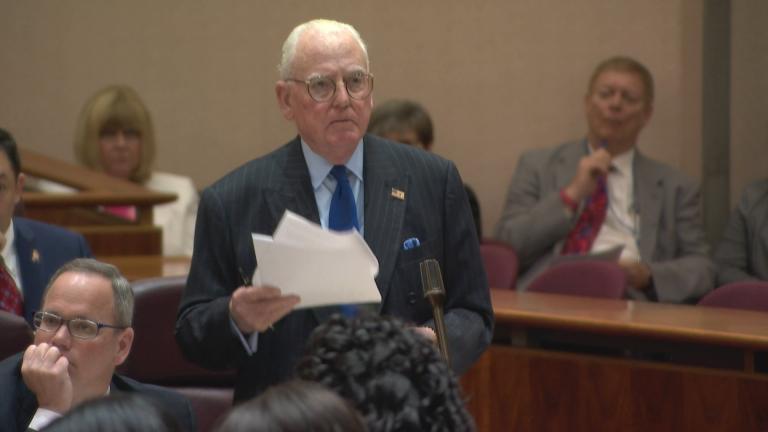

The nearly three-dozen pensioners and 17 individual pension funds that sued have already lost twice in lower court. But their attorney was insistent the retired police and firefighters were wronged when Gov. J.B. Pritzker signed the law – passed with overwhelming bipartisan support.

You may have heard Chicago has a pension problem … to the tune of more than $35 billion of debt. Pensions affect nearly everyone — even if you’re not a public employee. Taxpayers have already been footing the bill to alleviate the pension debt.

State Sen. Rob Martwick, the measure's author, praised Mayor Brandon Johnson for confronting Chicago’s pension woes. The bill ensures that all retired Chicago police officers get a 3% annual cost-of-living increase, regardless of whether they were born before or after Jan. 1, 1966.

The upgrade came from Fitch Ratings, the last remaining holdout of the nation’s three major credit reporting agencies to advance the state’s status to “A” grade. Collectively, Fitch, S&P Global Ratings and Moody’s Investors Service have given the state nine credit upgrades since 2021.

The working group formed by Mayor Brandon Johnson in June to tackle Chicago’s acutely underfunded pensions has yet to craft a comprehensive plan to address one of the major fiscal challenges facing the city.

The analysis by Fitch said the rating upgrade “is driven by a decline in the city’s long-term liability burden stemming from steady growth in the economic resource base and improved debt management practices.”

In all, Chicago owes $35.4 billion to its four employee pension funds representing police officers, firefighters, municipal employees and laborers, according to the 2022 Certified Annual Financial Report.

The working group formed by Mayor Brandon Johnson to tackle Chicago’s acutely underfunded pensions is set to meet for the first time this week to confront one of the major fiscal challenges facing Chicago’s new leader.

Former Ald. Ed Burke will start receiving pension payments of $8,027 per month in August, and they will continue for the rest of his life, according to records obtained by WTTW News from the Municipal Employees’ Annuity and Benefit Fund of Chicago.

Former Ald. CarrieAustin is now receiving more than $9,500 per month in pension payments for the rest of her life, according to records obtained by WTTW News from the Municipal Employees’ Annuity and Benefit Fund of Chicago. If Austin is convicted, she could lose her pension, since her conduct occurred as part of her official duties as an alderperson.

DCFS gained more than 100 employees between 2021 and 2022. Public health employees declined.

WTTW News analyzed state salary data and found some departments got smaller or had a noticeable uptick in employees leaving. Even in agencies that grew, employee churn was evident. We walk you through the numbers.

The upgrade is likely to boost efforts by Mayor Lori Lightfoot to convince Chicago City Council members to support her budget, which she hopes to pass on Nov. 7.

Chief Financial Officer Jennie Huang Bennett faced pointed questions from members of the City Council’s Budget and Government Operations Committee on Thursday about the "advanced pension payment" proposal.

In 2019, Chicago paid more than $1.31 billion to its four pension funds benefitting police officers, firefighters, municipal employees and laborers. In 2023, Chicago will pay more than $2.34 billion to the same four funds.

Budget Director Susie Park unveiled the updated budget forecast during Wednesday’s meeting of the City Council’s Budget and Government Operations Committee, which holds a hearing to examine the city’s financial condition every quarter.