A proposal from Mayor Lori Lightfoot’s administration to use property tax revenue generated downtown to fund the $3.6 billion extension of the CTA’s Red Line from 95th Street to the city’s southern border near 130th Street faces an uncertain future amid opposition from Chicago City Council members.

Ald. Pat Dowell (3rd Ward), an ally of the mayor and chair of the City Council’s Budget Committee, told the members of the Community Development Commission that she opposed the proposal, which she said would be a “bad deal” for residents of Bronzeville and set a bad precedent.

“I have strong misgivings about the creation of a Transit TIF that will take my constituents’ property tax obligations and apply them miles away,” said Dowell, in a rare appearance before the Community Development Commission to publicly oppose a proposal backed by the mayor.

The proposal from Lightfoot’s administration would create a new tax-increment financing district along the southern branch of the CTA Red Line to generate $950 million for the project by funneling a portion of the increase in property tax revenues for the next 25 years from the 42nd, 3rd, 4th, 11th and 25th wards — even though the extension of the train line would be miles away from any of those wards.

CTA officials have defended the plan by saying the extension will benefit the entire city — not just the Far South Side — by allowing people to get to work in the Loop 30 minutes faster while reducing carbon emissions from cars.

Lightfoot's representatives did not respond to a request for comment.

The city must match an expected federal grant of $2.16 billion to get the project first envisioned by former Mayor Richard J. Daley in the 1950s.

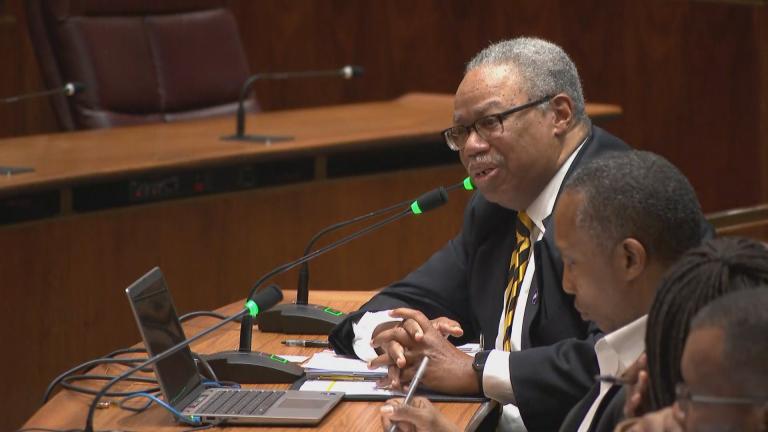

Ald. Anthony Beale, a frequent critic of Lightfoot whose Far South Side ward would directly benefit from the Red Line extension, called the mayor’s plan “short sighted.”

Beale said the federal government should cover the entire cost of the train line extension, which he has favored for more than a decade.

“Sometimes I do understand the city has to put some skin in the game,” Beale said. “But this is more than some skin. This is an arm and leg.”

After hours of debate on Tuesday, the commission unanimously voted Tuesday to authorize city officials to take the first steps toward creating the TIF, which would be the second of its kind in Chicago.

However, that vote came only after members of the Department of Planning and Development assured the members of the commission, who are appointed by Lightfoot, that they were only voting to start the process by authorizing a feasibility study of the new TIF district and allowing other city panels to begin considering the proposal.

The creation would need the approval of the Chicago City Council.

The city’s use of TIF districts has fueled a perennial argument over whether the districts, which capture all growth in the property tax base in a designated area for 23 years, actually spur redevelopment and eradicate blight or serve to exacerbate growing inequality in Chicago.

Typically, the funds generated by TIF must be used in the same area of the city that the taxes were generated. But the TIF proposed by Lightfoot would use the growth concentrated downtown and south of the Loop to fund the train line extension on the Far South Side, where property tax revenue has been stagnant or declining for many years — a reminder of the legacy left by modern segregation.

The city’s first Transit TIF was created in 2017 to fund the reconstruction of the Red, Purple and Brown lines on the North Side that is underway now.

Contact Heather Cherone: @HeatherCherone | (773) 569-1863 | [email protected]