Tax increment financing has become a key front in the debate over school funding.

The governor and his allies say Chicago could solve a lot of its public school system’s financial problems by getting rid of TIF districts. They and other critics say TIFs are starving Chicago Public Schools of hundreds of millions of dollars. But the mayor and other budget watchdogs refute the notion, saying that doing away with them could actually cost public schools money.

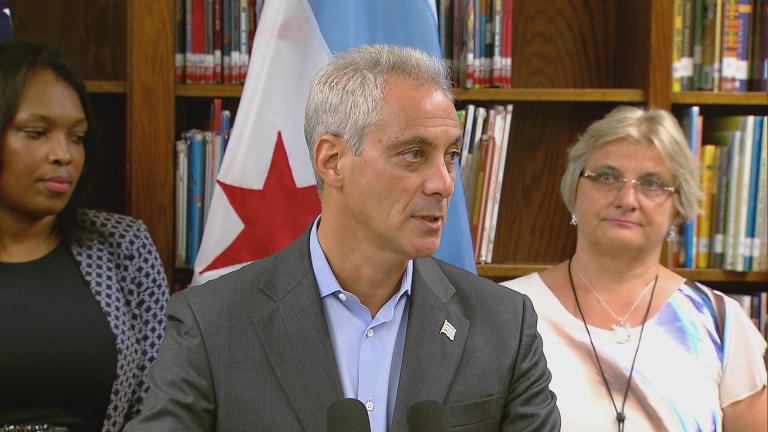

Mayor Rahm Emanuel on Monday slammed Gov. Bruce Rauner’s notion that the city has all kinds of property tax wealth sitting on the sidelines that could be used to fund Chicago Public Schools. But the governor, along with the allied libertarian think tank Illinois Policy Institute, argue that there are hundreds of millions of dollars sitting in these special funds—which he has called a “slush fund” for the mayor— that should be sent to schools instead.

“It allows an elected official to choose winners and losers, to decide who’s gonna get the money, who’s not gonna get the money, and that’s not a fair way to deal with taxpayer money,” said Chris Lentino with the IPI. “That’s why, at its core, there’s a problem with TIF.”

Critics have long argued that TIFs have deprived Chicago Public Schools of money it would have otherwise received. But factually, TIFs have not stolen money from Chicago Public Schools.

As a reminder—a TIF freezes the property value in that TIF district—any increase in property value and corresponding tax revenue goes into the TIF fund to spur economic development. What the Illinois Policy Institute and governor now argue is that if you retired all the city’s TIF districts—a future amount of about $300 million could go into CPS coffers. But the Civic Federation’s Laurence Msall says that’s an unlikely scenario; that that’s assuming you can pull out of projects that TIF money has already been committed to, and says that TIFs have actually resulted in more money to CPS by investing in projects that have boosted the economy and expanded the pot of money CPS can tap into.

“TIFs have definitely been a positive benefit for Chicago Public Schools, not only through the growing of the economic base and property value, but routinely the city declares a surplus and gives the schools half of all that revenue,” Msall said.

Experts and watchdogs seem to differ on whether or not can TIF districts simply be dissolved and the money returned to schools, especially if most of the money is already committed to fund certain projects.

Plus, CPS is limited by the PTELL law, or property tax extension limitation law. The total property tax levy can only rise 5 percent every year and Msall says the General Assembly would have to address that law as well as TIF law.

The mayor echoes Msall’s comments and a Chicago Tribune report over the weekend that says when there are surplus funds in these accounts, the money has gone to schools for both capital construction and into the classroom— hundreds of millions’ worth over the last several years. He says the governor is plain wrong on the math regarding TIF.

“The mayor of Barrington opposed what he said,” Emanuel said. “Mayors across the state, Democrats and Republicans, suburban urban and rural all know that when it comes to funding and TIFs, the governor is wrong.”

And indeed the mayor of Barrington wrote a letter to the governor saying:

“(TIF) districts are not only an essential tool, but frequently the only tool available for municipalities to revitalize blighted properties over time. Blighted properties underperform economically, depress nearby property values and ultimately reduce the amount of property tax revenue collected by local governments, including school districts. (TIF) was designed to benefit communities by rehabilitating these underperforming properties so they can make positive economic contributions to the surrounding property tax base and the community as a whole.”

Rauner wants the new education funding formula to take into account TIF districts, essentially claiming Chicago’s property wealth is understated, because it is not including the value of properties that are generating TIF revenue. That means that the city would get about $200 million less from the state because the city wouldn’t be as property tax poor as it appears to be.

But communities without TIF districts would proportionately benefit because all of their property tax wealth is accounted for.

Follow Paris Schutz on Twitter: @paschutz

Related stories:

Legislators Condemn Rauner’s Reaction to Political Cartoon

Legislators Condemn Rauner’s Reaction to Political Cartoon

Aug. 22: Top legislators spent hours Monday working on an education funding package, and reaction to a political cartoon is still simmering.

Emanuel, CPS Using Student Achievement in Fight for Funding

Emanuel, CPS Using Student Achievement in Fight for Funding

Aug. 22: Chicago Public Schools says its English language learners have significantly trimmed the achievement gap compared to native English speaking students – a data point Mayor Rahm Emanuel and district officials want to use in their ongoing fight for adequate funding from Springfield.

CPS Budget Hearings: Get Dates, Times for August Meetings

CPS Budget Hearings: Get Dates, Times for August Meetings

Aug. 15: Chicago Public Schools has five hearings scheduled on various aspects of its latest spending plan this month, beginning Monday with meetings on its capital budget. Get complete details.