Stocks hit a record high Monday, with the Dow Jones Industrial Average closing above 18,600.

But talk from the president of the New York Federal Reserve that a September interest rate hike was possible sent the markets into retreat a bit Tuesday.

Is the market set for more gains, or are stock prices getting ahead of fundamentals?

Joining us Tuesday to share their professional wisdom are Brian Battle, a director at Performance Trust Capital Partners who has been working in the capital markets for nearly 30 years; and Susan Schmidt, senior vice president, portfolio manager and research analyst at Westwood Holdings Group.

Below, a Q&A with Battle.

Chicago Tonight: Wall Street hit a record high Monday but then fell away a little today after comments from the president of the New York Federal Reserve about a possible September interest rate hike. How are you feeling about the markets right now?

Brian Battle appears on “Chicago Tonight” in July 2013.

Brian Battle: The markets are setting all-time highs, which is interesting but I’m not sure that it is indicative of where the economy is. I believe the market is rallying because of the lack of alternatives. In a zero interest rate environment you buy dividend-paying stocks because you get a yield, so there’s a lot of risk-seeking behavior in the stock market, people are just trying to get yield wherever they can. The thing that is driving the stock market is central bank policy, and I think we can all agree that low, low, low engineered rates by the Federal Reserve, the European Central Bank and the Bank of Japan are forcing rates down. And those lower rates–and sometimes even negative rates–is driving a lot of the stock market performance.

Brian Battle appears on “Chicago Tonight” in July 2013.

Brian Battle: The markets are setting all-time highs, which is interesting but I’m not sure that it is indicative of where the economy is. I believe the market is rallying because of the lack of alternatives. In a zero interest rate environment you buy dividend-paying stocks because you get a yield, so there’s a lot of risk-seeking behavior in the stock market, people are just trying to get yield wherever they can. The thing that is driving the stock market is central bank policy, and I think we can all agree that low, low, low engineered rates by the Federal Reserve, the European Central Bank and the Bank of Japan are forcing rates down. And those lower rates–and sometimes even negative rates–is driving a lot of the stock market performance.

Historically, what drives stock market performance is expectation of future earnings. The stock market is supposed to reflect the conditions of the economy, and right now I don’t think that’s true. Earnings on the S&P (500 Index) have been falling for the last 18 months and we have a record high. So I think what’s driving stock market performance is engineered and really, really low interest rates.

Stocks are rallying because there is a lot of momentum for them on the way up, and if that condition changes and the Federal Reserve is not as accommodating anymore, then that can reverse just as fast. It was a big deal today that Bill Dudley (president of the New York Federal Reserve) said that a rate hike was possible. There’s no telling what the Federal Reserve is going to do, so instead of betting that Apple is going to sell a million iPhones this week, you’re trying to guess what 12 people on the Federal Reserve is going to do, and that’s speculation and not fundamental financial analytics.

CT: Federal Reserve options seem to be to leave rates the same or raise them, given they are already at historically low levels.

Battle: That’s not necessarily true. Rates can go lower from here. In the world’s developed economies, the U.S. has the highest futures rates in the world – the U.S. 10 year treasuries are at about 1.5 percent but in Germany it’s negative. So there’s plenty of room for rates to go down.

Negative interest rates and zero interest rates are an indication of failed monetary policy, not of a strategy on monetary policy. If you are the central bank and you have to set rates to zero or negative, it’s not working.

CT: So what should the Federal Reserve be doing at this point?

Battle: The U.S. Federal Reserve has a dual-mandate; two things that they are entitled to do. One is have a stable level in interest rates and two is to have a stable value for the currency.

They’ve taken their mandate and substituted their job for the Congress. We’ve gotten to the point now where we’ve exhausted the utility of monetary policy. You can’t lower rates anymore – they are almost at zero and they’ve been going down for eight years. The economy should be booming yet we’ve got only 2-percent growth. This is the weakest “recovery” we’ve had in history.

What we need is for the Federal Reserve to say that you know what, we’ve done all we can and maybe it’s time for fiscal policy, maybe it’s time for Congress to do their job. They could do three things: they could change tax rates, they could change regulation and make trade easier or harder and do some stimulus from the fiscal side instead of from the monetary side.

CT: How are the markets looking at the presidential election and the polls pointing toward a victory for Hillary Clinton?

Battle: We have two candidates that seem pretty different. Candidate Clinton is promising more of the same, so she’s a pretty status quo candidate. With Donald Trump it’s not really clear what he stands for yet. There are two things that the markets are going to bet on, one is what does the candidate stand for and second, what is the probability of them getting elected. So right now I don’t think the markets are handicapping the election in any way because you can’t tell what Trump stands for and it kind of looks like a tie. Those details will start getting worked out the closer we get to November.

One point about stocks and bonds is that usually they do the opposite, so when the stock markets rally there’s a sell-off in bonds. But in the last eight years stocks and bonds have rallied, so rates have gone down and stock prices have gone up. So it doesn’t violate any law of mathematics or history to think that interest rates could rise and the stock market could get crushed. If they could rally together, they both could sell-off together.

CT: Does it feel like this is the new normal or do you think ultimately things will revert to the historical trend? Are we in a new market at this point?

Battle: We are definitely in a new market. The Federal Reserve has their thumb on the scale of the markets. We have a massive, non-economic market participant and that is the Federal Reserve. And the Federal Reserve has decided that they want interest rates to be lower, so they don’t care what price they pay for bonds. So the Federal Reserve has gone from having an $800 billion balance sheet to a $4 trillion balance sheet and they are affecting the markets. As I said earlier, this is a failure of monetary policy. The Federal Reserve has crushed the price signals for credit, they’ve made all interest rates low … you used to be incentivized to save money: you would get paid more interest for a two-year deposit than a one-day deposit. It used to be that when the interest rates were this low that would signal that the bond market was anticipating a major recession in the U.S. To have the 10-year treasury rate at 1.5 percent is absurdly low, you would think the value of the stock market would be a third of what it is – but those things don’t correlate anymore.

The Fed has probably done as much as it can, and if there were a disaster tomorrow, it doesn’t have any bullets left. You can’t take rates any lower than zero – I suppose they could go negative. They have to revert to more normal policy so they have more room for themselves (to maneuver) for the next crisis.

CT: It seems that every time the Fed signals a possible rate hike the market overreacts and then the Fed gets cold feet and worries about killing off the recovery. How can they get that balance right?

Battle: Well, they’ve painted themselves into a corner. They probably should have reverted to a more normal policy at the end of the financial crisis. The whole point of the Federal Reserve is that you take away the punch bowl just as the party gets going. If you’re the central bankers, you’re the wet blanket at the party – you take away an accommodative monetary policy just when the economy feels OK and they’ve been unable to do that. And now, eight years later they’ve gotten themselves into a jam. They are going to have to raise rates sooner or later and it’s going to hurt.

CT: There must be some younger market professionals who’ve never seen the Fed raise rates.

Battle: You’re absolutely right. I think the statistic is something like a third of market professionals.

We are in an era of experimental monetary policy; it has never happened before that rates have been this low for this long. So the exit from this monetary policy is also going to be experimental because we’ve never been here before. So like Yogi Berra says, “Making predictions is difficult, especially about the future.”

CT: Only a few months ago we had a big sell-off because of Brexit – at the time that was considered a big deal, so how have we hit record highs so quickly since then?

Battle: There were two sell-off events of import this year. The first was the Brexit vote and that was a political sell-off. The majority of investors didn’t think it would happen so everybody got surprised. That was a currency sell-off driven by the value of the pound to the euro and other currencies. That was a short-term impact and the U.K. is a relatively small economy.

The more important sell-off was the 10 percent sell-off at the beginning of the year when China said, “Hey, our economy is crummy. We are going to devalue the yuan.” If you can make your currency cheaper that makes your exports cheaper. (And China could do the same again.)

CT: What do the fundamentals look like at the moment? Where is the smart money?

Battle: If you’re a fundamentals analyst you hate the stock market because fundamentally earnings aren’t that great. Global growth or global GDP is 2 percent or lower and the stock prices don’t reflect economic activity. So fundamentally, you’d say the stock market seems really overvalued. So that would make you to want to minimize your bets. And certainly you’d want to minimize your bets overseas because only the U.S. has any sort of growth.

The other thing is you can’t call interest rates – all you can do is make relative judgments between investments.

As an investor and not a trader you should certainly have a long-term time horizon and the call of the day is prudence. Because we are at the all-time highs you’re upside is another all-time record and your downside is way more recent.

Related Stories

US Federal Reserve Expected to Increase Interest Rate

US Federal Reserve Expected to Increase Interest Rate

May 24: Excitement on Wall Street as a possible interest rate hike approaches. Why some surprises in the U.S. economy have investors and analysts feeling good.

Global Markets Calmer, But Worries About China Persist

Global Markets Calmer, But Worries About China Persist

Jan. 5: After a big sell off Monday, international markets appeared more settled today. What's causing the concern, and how will the Fed's rate hike affect the U.S. economy in 2016? Two local economists join us to discuss the global markets and last month's long-awaited announcement of a U.S. interest rate hike.

US Fed Rate Hike: Will It Come in September?

US Fed Rate Hike: Will It Come in September?

Sept. 15, 2015: The Federal Reserve’s two-day meeting begins, and officials will decide whether or not to increase interest rates for the first time in years. We discuss the possibility of a quarter of a percentage interest rate hike.

Devaluation in China Leads to Jitters in US, Global Economy

Aug. 13, 2015: For the third day in a row, China devalued its currency. That devaluation led to jitters in financial markets around the globe. Since Monday, the Dow Jones alone has fallen 500 points.

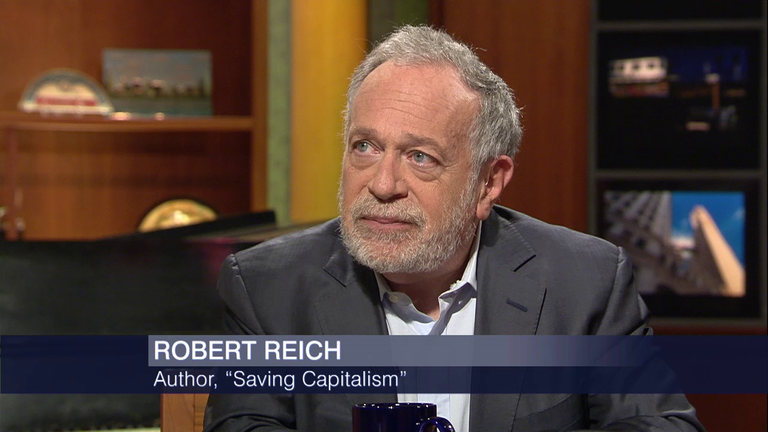

Why Robert Reich Wants to Save Capitalism

Why Robert Reich Wants to Save Capitalism

There's no such thing as a true free market: That's the bold proposition former Labor Secretary Robert Reich makes in his newly released book, "Saving Capitalism."

New Book Examines Risk of Mortgage Giants Fannie Mae and Freddie Mac

New Book Examines Risk of Mortgage Giants Fannie Mae and Freddie Mac

Chicago-based business writer Bethany McLean makes the case that mortgage giants Fannie Mae and Freddie Mac are in a precarious state in her new book, "Shaky Ground."