It’s a mind-boggling amount of money for anybody to consider spending – let alone a teenage. The cost of four years of college – including room, board and books – can now top $200,000 at a private school. Four years at a public university can top $100,000, according to the College Board.

But for most, there is help in the form of state and federal grants, as well as financial aid from schools and scholarships.

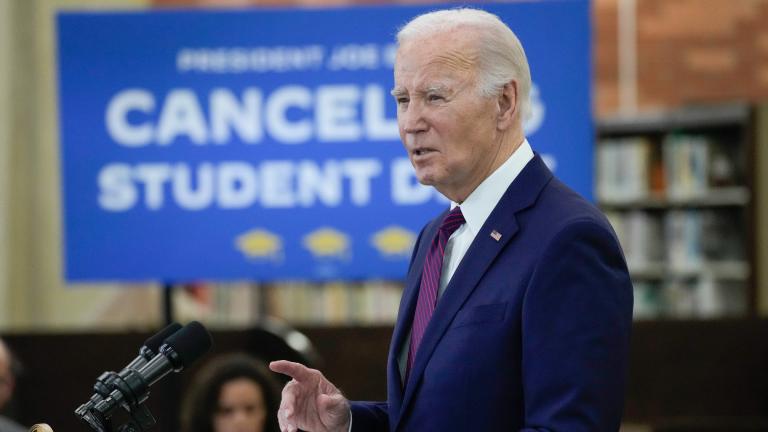

Students can also apply for loans. But a new study by Harris Poll for NerdWallet found that 45 percent of recent undergraduates have student loan debt, and 39 percent don't think they'll pay off that debt within the 10-year loan period. The average college graduate with a bachelor’s degree left school with $28,446 in student debt in 2016.

Experts say the first and most important step to avoiding college debt is to apply for financial aid, grants and scholarships by filling out a lengthy form called the Free Application for Federal Student Aid, or FAFSA, which opened on Oct. 1.

“It looks really daunting when you first look at it,” said Lynne Baker, managing director of Communications at the Illinois Student Assistance Commission. “If I send any message today it would be, Do not panic. It really isn't that difficult.”

ISAC and its partners are hosting free workshops at high schools and public libraries to help students and parents fill out FAFSA and college applications.

To find a workshop or connect with one of ISAC’s peer mentors, visit the organization’s website.

Baker joins Chicago Tonight to discuss college financing.

Related stories: