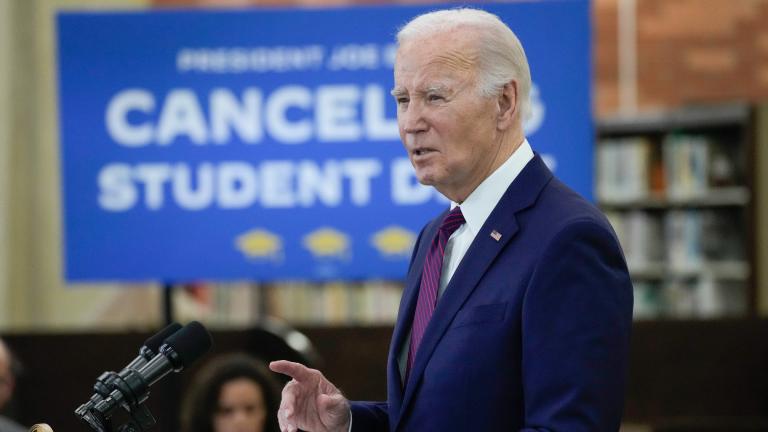

It’s a more targeted proposal than the one the U.S. Supreme Court struck down last year. The new plan uses a different legal basis and seeks to cancel or reduce loans for more than 25 million Americans.

Student Debt

The first major overhaul of the FAFSA form since the Reagan era was supposed to make the process simpler and quicker. So far, that’s not been the case.

Joe Biden, who is in the midst of a three-day campaign swing through California, made the announcement as part of a new repayment plan that offers a faster path to forgiveness, putting the spotlight on his debt cancellation efforts in his reelection campaign.

Students can usually fill out the FAFSA starting in October, but the 2024-2025 version only became available last week because the Department of Education was still working on the new form.

The Free Application for Federal Student Aid, or FAFSA, form is undergoing its first major overhaul since the Reagan era.

The average student loan debt for Illinoisans is nearly $38,000. Almost 55% of the more than 1 million borrowers in Illinois are under the age of 35, according to the Education Data Initiative.

The 6-3 decision, with conservative justices in the majority, effectively killed the $400 billion plan, announced by President Joe Biden last year, and left borrowers on the hook for repayments that are expected to resume by late summer.

Millions applied for student loan forgiveness before President Joe Biden’s plan was put on hold amid legal challenges. The forgiveness plan’s fate is now in the hands of the U.S. Supreme Court, which just heard arguments on the case.

The Supreme Court is about to hear arguments over President Joe Biden’s student debt relief plan, which impacts millions of borrowers who could see their loans wiped away or reduced.

About 26 million people had already applied to the program by the time a federal judge froze it on November 10, prompting the government to stop taking applications. No debt has been canceled thus far.

The ruling by the three-judge panel from the 8th U.S. Circuit Court of Appeals in St. Louis came days after a federal judge in Texas blocked the program, saying it usurped Congress’ power to make laws.

A new student loan debt relief plan will cancel up to $10,000 in federal loans for individuals making less than $125,000 a year. For low-income students who received Pell Grants, they can receive up to $20,000 in student loan forgiveness. According to research by Excelencia in Education, 50% of Latinos in higher education receive federal Pell Grants to help pay for college.

President Joe Biden unveils his student debt relief plan. A conservative group’s political ad darkens Mayor Lightfoot’s skin. Our politics team weighs in on those stories and more.

Borrowers who earn less than $125,000 a year, or families earning less than $250,000, would be eligible for the $10,000 loan forgiveness, Biden announced. For recipients of Pell Grants, the federal government would cancel up to an additional $10,000 in federal loan debt.

Navient, the second largest student loan servicer in the U.S., agreed Thursday to cancel $1.7 billion in debt owed by more than 66,000 borrowers across the country as part of a multistate lawsuit that accused the company of abusive lending practices.

What began as a proposal by a presidential candidate has since turned into a heated debate over managing the nation's trillion dollar student debt burden.