In coming years, Chicago will need to find billions of dollars in new revenue to stabilize its beleaguered debt and pension obligations. And today there's renewed talk of an idea that has been shot down in the past: a city income tax. How would it work? Is it politically viable? And what would the impact be?

Ald. Joe Moore (49th Ward) says the idea would be to institute an income tax only on income over a certain level – so only the higher earners would pay.

Ald. Joe Moore (49th Ward) says the idea would be to institute an income tax only on income over a certain level – so only the higher earners would pay.

This is because by law any income tax in Illinois must be flat, not multi-tiered. Moore made his comments about reviving talk of a city income tax in the Chicago Sun-Times.

The idea has aldermen split.

“I hope it happens,” says Ald. Walter Burnett (27th ward). “We can’t keep putting everything on property owners. We raise water bills. We raise taxes. Property owners get the bulk of everything. If you do an income tax, you spread the pain, everybody participates, and that’s only fair.”

Other aldermen expressed their ambivalence.

“At this point in time, I’m not in favor,” said Ald. James Cappleman (46th Ward) “But at this point in time, I do think we have to throw out all options. There are a lot of bad options. We have to choose the best of the bad options.”

Still others rejected the idea outright.

“I think another flat tax would be regressive on a majority of citizens in our city,” said Ald. Jason Ervin (28th Ward). “We already have a flat income tax in the state, so to add another flat tax would not be a step in the right direction.”

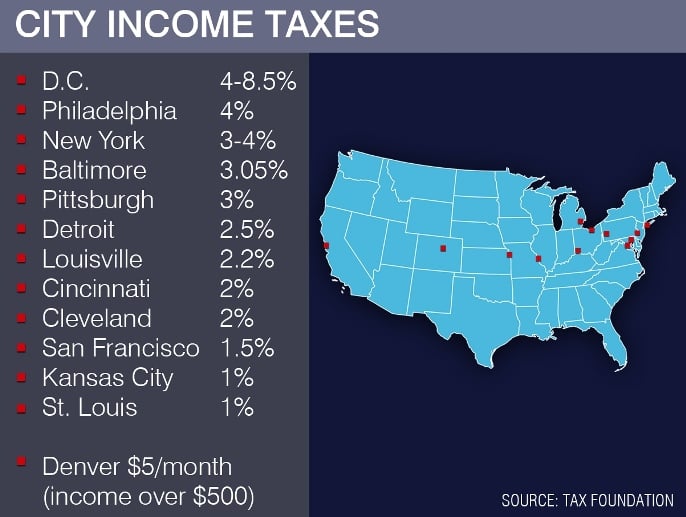

There are many cities across the country that levy a city income tax.

View a map highlighting cities with income taxes.

Plus, there are hundreds of counties and school districts across the country that levy their own income taxes.

Though all tax votes are tricky, an income tax may be the trickiest because it would need approval from the General Assembly, and it would have to be flat unless lawmakers passed a constitutional amendment to make it multi-tiered.

Gov. Bruce Rauner’s office told us today that he would be opposed to any measure calling for a city income tax. He has not spoken about it with the mayor – who has also expressed ambivalence for it in the past.

For these reasons, some of the city’s top municipal finance experts say energy would be better spent looking for other forms of revenue.

“We’ve seen in many places, New York City or Washington, D.C., there was a surge of businesses created outside the municipalities,” said The Civic Federation President Laurence Msall. “It’s a disincentive.”

But the more left-leaning Ralph Martire of the Center for Tax and Budget Accountability says he believes those concerns are unfounded.

“A lot of the fear-mongering about the negative aspects frankly doesn’t come into play, the bigger concerns are the procedural hurdles you’d have to go through in Springfield to get it done,” Martire said.

And an Inspector General report from 2011 found that a 1 percent city income tax could bring in $500 million a year. He outlined other options and the amount of money they could bring in each year, including:

- Commuter Tax: $300 million

- Broaden Sales Tax: $450 million

- Congestion Pricing: $235 million

- Broaden Amusement Tax: $105 million

Both budget experts, though, say the most logical place to look right now is the property tax, as the city faces a tripling of the money it will have to put into police and fire pensions in the next five years when it will total almost a billion a year.

Not to mention a $634 million CPS teacher pension payment it owes in the coming weeks, with no clear way to pay for it yet.