UPDATE: Civic Federation President Laurence Msall joins host Phil Ponce on Tuesday to discuss the report.

The state of Illinois will not get out of its budget hole without a significant income tax hike, according to a new report issued by the Civic Federation, a fiscal watchdog group.

The report recommends raising the state income tax from the current level of 3.75 percent to 5.25 percent, retroactive to Jan. 1, 2017. It also recommends a hike in the corporate income tax from 5.25 percent to 7 percent and extending the income tax to cover retirement income, which is currently untaxed.

The report makes clear that the length of the budget standoff, now 19 months and counting (not including a temporary stopgap budget that recently expired) has done nothing but make the problem worse, and the solutions more difficult.

“Governor Rauner and Illinois legislators on both sides of the aisle need to take action immediately to put Illinois back on the path toward sound financial footing,” said Laurence Msall, Civic Federation president. “Ending the impasse is the right thing to do for Illinois taxpayers, the state’s vendors and especially our most vulnerable citizens, who have been irreparably harmed during the last 19 months.”

Msall points to Illinois’ credit rating, which is the worst in the nation, as a critically damaging factor for the state’s finances.

“Having such a low credit rating means the state has to pay exorbitant amounts of interest any time it borrows,” Msall said. “And the state regularly borrows money.”

The report recommends lowering the state share of the sales tax on goods and services from 5 percent to 4.25 percent, but it calls for expanding the base to include services that are not currently covered.

Other recommendations in the report include:

• Limiting spending growth to 1.7 percent per year.

• Expanding the earned income tax credit by 50 percent to limit the effects of the tax increase on low-income residents.

• Eliminating certain business tax expenditures that it believes “do not provide sufficient public value to justify their cost,” including the E-10 ethanol incentive.

• Merging the Chicago and state teachers’ pension funds. Mayor Rahm Emanuel has long blasted the fact that Chicago taxpayers pay income tax to support state teacher pensions, while they also pay property tax to support the Chicago Teachers’ Pension Fund.

• Consolidating and streamlining government units in Illinois.

• Borrowing to pay the bill backlog.

The Civic Federation’s plan projects the state will solve its bill backlog by 2022. But if the state continues along its current path, the report estimates that the backlog could grow to a stunning $48 billion by the same year.

The state is currently operating between $5 billion to $6 billion in the red, with a backlog of $14.4 billion, meaning that more and more providers are waiting longer periods of time to get paid for services they’ve already provided.

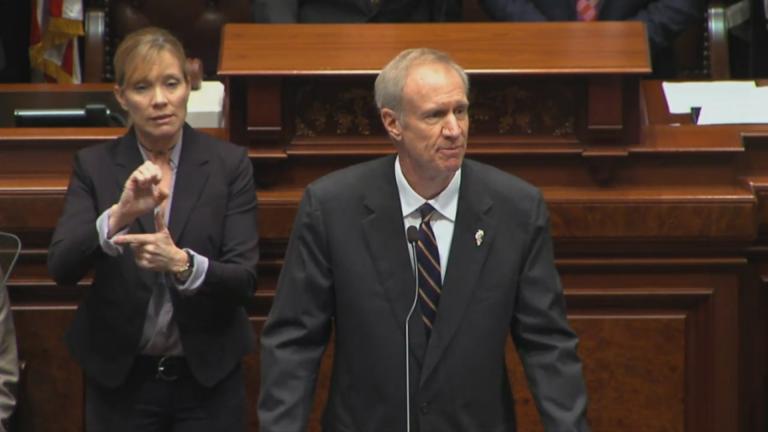

Msall said the governor’s office received the Civic Federation’s report and that Rauner “is aware of it.” The governor is scheduled to deliver his third budget address to the General Assembly on Wednesday.

Evan Garcia contributed.

Follow us on Twitter: @paschutz | @evanrgarcia | @WTTW

Related stories:

Rauner Calls Trump Immigration Ban ‘Overly Broad,’ ‘Rash’

Rauner Calls Trump Immigration Ban ‘Overly Broad,’ ‘Rash’

Feb. 10: Gov. Bruce Rauner criticized President Trump’s executive order and discussed ongoing issues with Chicago Public Schools and education funding during an interview on WBEZ.

For Second Time, First Lady’s Nonprofit Sues Governor

For Second Time, First Lady’s Nonprofit Sues Governor

Feb. 9: The early childhood support program run by Diana Rauner, wife of Illinois Gov. Bruce Rauner, is once again part of a coalition suing the state to recover money it’s owed.

Civic Federation: Illinois Needs $9.4 Billion in New Taxes by 2019 to Survive

Civic Federation: Illinois Needs $9.4 Billion in New Taxes by 2019 to Survive

Feb. 11, 2016: New taxes – and lots of them. That's what Illinois will need to dig out of its current fiscal mess, according to a new report from the Civic Federation.