In 2013, Harold Pollack came up with a nine-point index card of common-sense financial advice after a conversation with journalist Helaine Olen. Now, the two have expanded the card slightly into a book designed to put the average person on the road to financial well-being and steer them away from the ubiquitous cacophony of unscrupulous and unrealistic financial advice. Harold Pollack joins “Chicago Tonight” to discuss the book.

Origin of the list

When University of Chicago professor Harold Pollack was interviewing journalist Helaine Olen about her book “Pound Foolish," he made the offhand remark that the financial advice most people actually need is common sense and simple enough that it would fit onto a 4-by-6 index card.

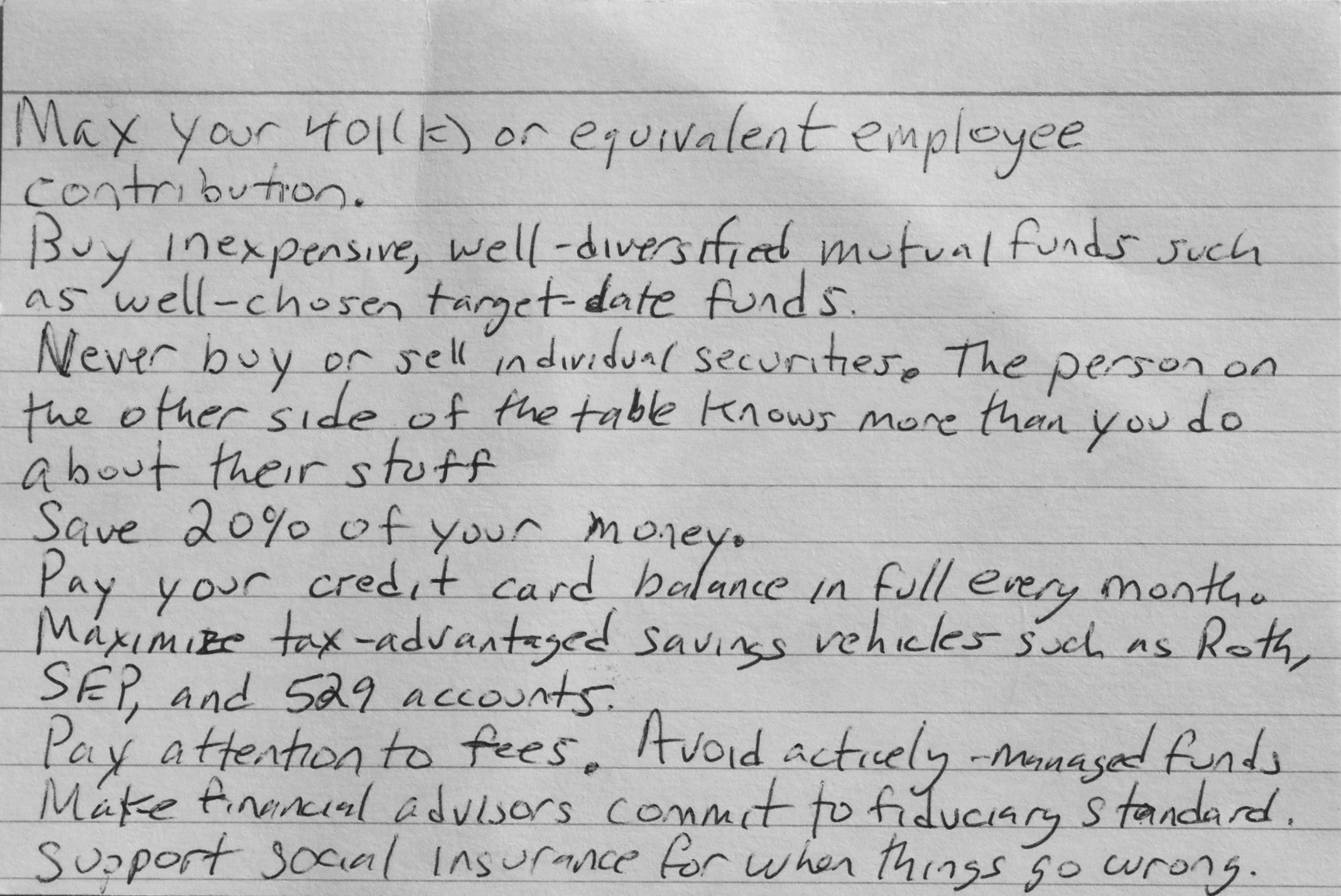

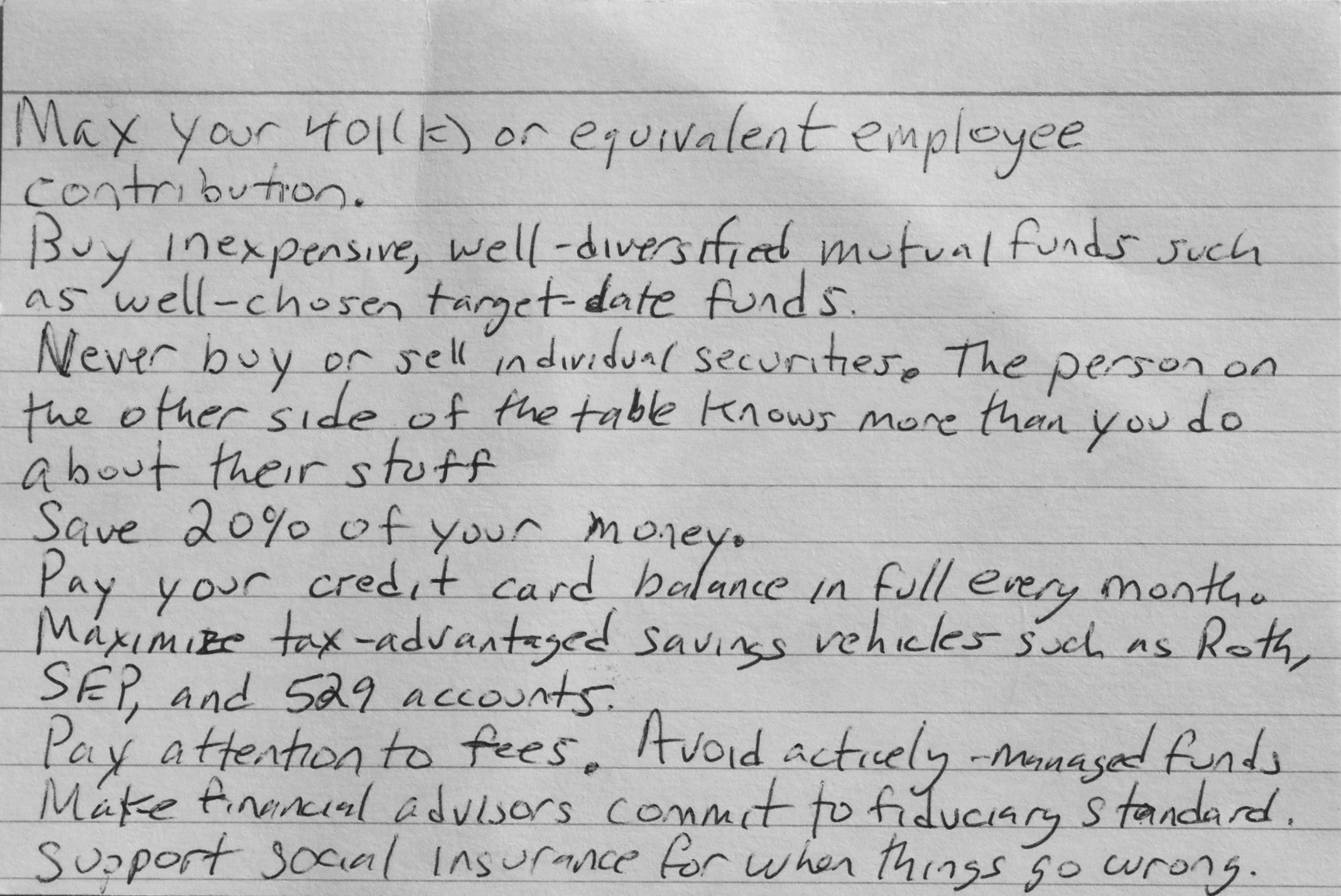

“I started getting emails saying, ‘Where’s the index card?’” Pollack recalls. So even though it had been more or less a joke, he decided (if you’ll excuse the pun) to put his money where his mouth was. “I reached in the drawer, grabbed one of my daughter’s index cards, and scribbled down in about two minutes nine sensible things.”

Pollack posted a picture of the card online and it quickly went viral, covered by everyone from the Washington Post to Lifehacker and Boing Boing. “Sites I’d never heard of,” Pollack laughs.

Pollack and Olen expanded on the nine concepts to create the just-published book “The Index Card: Why Personal Finance Doesn’t Have to be Complicated.” The book is a common-sense counterpoint to the scores of financial advice hawkers who Pollack and Olen see as steering the average consumer down a foolish path.

“There’s a cacophony of financial advice presented to ordinary consumers, and then there’s a conversation taking place among people who are experts in the subject,” Pollack said. “So much of what’s in the public conversation about finance is contrary to what the experts know to be the case – certainly, everything on financial TV is contrary to what the experts understood pretty well.”

For example, Pollack says numerous academic studies back up the idea that it’s a mistake for consumers to pick stocks. “At one level, that really punctures your ego to realize that, because we all want to be the person who bought Apple stock in 1996 and held onto it and made a fortune. But on another level – wow – what a relief! Think of how much time and effort that saves.”

Another of Pollack’s principles is to support the social safety net. After his mother-in-law died suddenly, Pollack and his wife started taking care of her intellectually disabled brother – a major motivator to get their family’s finances in order. But he also credits programs that help to fund his brother-in-law’s care.

“I save and I invest, but I would have been wiped out if not for public programs that helped my family,” Pollack said. “I want to be honest about that and honor that. We all have to protect each other against the massive risks that would crush any one of us if we had to face it alone.”

Pollack says the concepts on the card and in the book aren’t exactly rocket science, but that the simplicity of the list helps people to deal with their finances without fear. “It turned an incredibly intimidating problem – oh my God, I have this retirement challenge facing me, I’ve got to save for my kids’ college tuition – and it starts to change it to, OK, there are things on the card to understand and execute. I think I can do that.”

Read an excerpt from the book, "The Index Card: Why Personal Finance Doesn't Have to be Complicated," below.

The Index Card Story

When Pound Foolish was published, Harold contacted Helaine and interviewed her on the Reality‑Based Community blog. During their Internet chat, Harold offhandedly noted that the fundamental dilemma facing the financial services industry is that the correct advice for most people fits on a three-by-five-inch index card and is available for free at the library.

A surprising number of people wrote to Harold, asking for the card. Because he was speaking metaphorically, this was a problem. But he had promised. So he pulled one of his daughter’s index cards out of her backpack, picked up a pen, and in maybe three minutes wrote down some of the simple and basic financial rules he and Veronica had been living by for the past decade. He then snapped a crude picture with his smartphone. This is what it looked like:

Harold posted the photograph on his blog, and things quickly went viral. There were hundreds of thousands of hits around the Internet. A life coach copied it word for word and read it aloud in a YouTube video. The card was even translated into Romanian. There were also shout-outs from people who have deep knowledge about personal finance, economics, and investments.

“Pollack’s right. Follow these principles and you’ll be in much, much, much better shape than most Americans—or most anyone,” wrote Ezra Klein over at the Washington Post.

“Your new financial advisor is Harold Pollack’s index card,” declared the website Boing Boing.

Marketplace, Forbes, the Huffington Post, Reddit, and Lifehacker discussed it.

The MacArthur fellow Sendhil Mullainathan tweeted the card out. So did top economists like Justin Wolfers. Vanguard mentioned the index card on its blog and e-mailed a picture of it with accompanying information in a “Money-Whys” New Year’s investment advice message to its subscribers. Money magazine called it one of the “best new money ideas” of 2013. The Minneapolis Star Tribune wrote, “The most notable personal finance writing of 2013 . . . was a handwritten 4 × 6 index card.”

There were thousands of comments and tweets, Facebook likes, and LinkedIn shares. Among the index card’s many fans? Helaine, who knew she finally had an answer for her readers. Rather than people relying on the so-called expert advice of the financial industry to dig them out of their money troubles and provide them with a magic bullet, she and Harold knew instinctively that the answer was much simpler and that it lay not with the experts but within ourselves.

One quick note: You’ll notice we made a few alterations to the original index card. Most of these changes were either organizational or for wording, but a few are more significant. Most important: Harold originally suggested that people save 20 percent of their pretax income. It’s a terrific goal. It’s also all but impossible for many of us. Aiming for 10 to 20 percent is a more realistic long-term strategy. We also eliminated the recommendation to use target-date funds—read on to find out why. Finally, we felt it was important to include insurance and housing, both of which didn’t make it onto the original card.

Keep it Simple —The Only Story You Need to Know

So a question: If the rules are so simple, why do you need more than an index card—heck, a book—to explain them?

Most of us don’t want to follow rules unless we know why they are rules. This book explains how the rules work and why we chose them. They may be simple, but they aren’t always self-explanatory.

Simplicity—as anyone who has ever tried to perfect a golf swing knows—often takes work and insight to achieve. Just telling you financial rules to follow is not the same thing as showing you how to master them so that you can follow them with confidence. And you will need to because ...

There is a whole industry of financial services advisors out there who make their living by convincing you that it’s naive to believe that simplicity, common sense, and restraint are potent enough weapons with which to deal with the whirlwind of financial chaos facing any of us on any given day. They make their money by convincing you that investing is so complicated, you need to turn it over to them. Or they convince you that they—as insiders, as “professionals”—have the ability to outsmart everyone else and know exactly what investment scheme will outperform the S&P 500.

The financial world offers an odd juxtaposition. The financial products we use in our day-to-day lives—credit cards, mutual funds, mortgages—are often quite complicated. But that doesn’t mean the way we lead our financial lives needs to be equally complicated.

Between Helaine’s experience covering the pitfalls and traps of the financial services industry and Harold’s proven practical solutions to his own financial problems, we can help you take control of your financial life.

So by following the nine simple rules as outlined on our index card, you will

- have the confidence to make your own financial decisions;

- discover basic financial truths such as that low-fee index funds outperform just about any more complicated investment you can buy and that simple fixed-rate mortgages remain the best way to borrow money to buy your house;

- be armed with a timeless set of guidelines that you can turn to no matter what financial issues you may face or how drastically the winds of financial change shift; and

- be sure you never make the same mistake Sam made and let your fears about the financial unknown prevent you from doing anything.

Ready to finally take action and begin the next phase of your financial life?

Good. Let’s get started.

Excerpted from The Index Card: Why Personal Finance Doesn’t Have to Be Complicated in agreement with Portfolio, an imprint of Penguin Publishing Group, a division of Penguin Random House LLC. Copyright © Helaine Olen and Harold Pollack, 2016.