Advocates and lawmakers are calling for a permanent child tax credit to help lessen the economic burden on struggling families.

The expansion of the child tax credit during the pandemic — which included cash payments to families for six months — lifted more than 2 million children out of poverty, according to the U.S. Census Bureau.

Child poverty went from 9.7% in 2020 to 5.2% in 2021, the lowest rate on record.

State Rep. Mary Beth Canty (D-Arlington Heights) is a chief co-sponsor of a bill in the state House that would enact a permanent child tax credit.

“It’s a really big issue that we have here in Illinois,” Canty said. “We know that this is something that has to be dealt with at the federal level, but the states also have a real opportunity to make a difference. … What we’re looking to do is a $300 per dependent child refundable tax credit. So even if you don’t owe taxes, you would still be getting cash in hand. … These funds would allow households to do what they think is right for their family.”

According to Canty, there are 14 other states that are running similar programs.

Those who would be eligible for the full amount are joint filers earning less than $75,000 per year and single filers earning less than $50,000 per year.

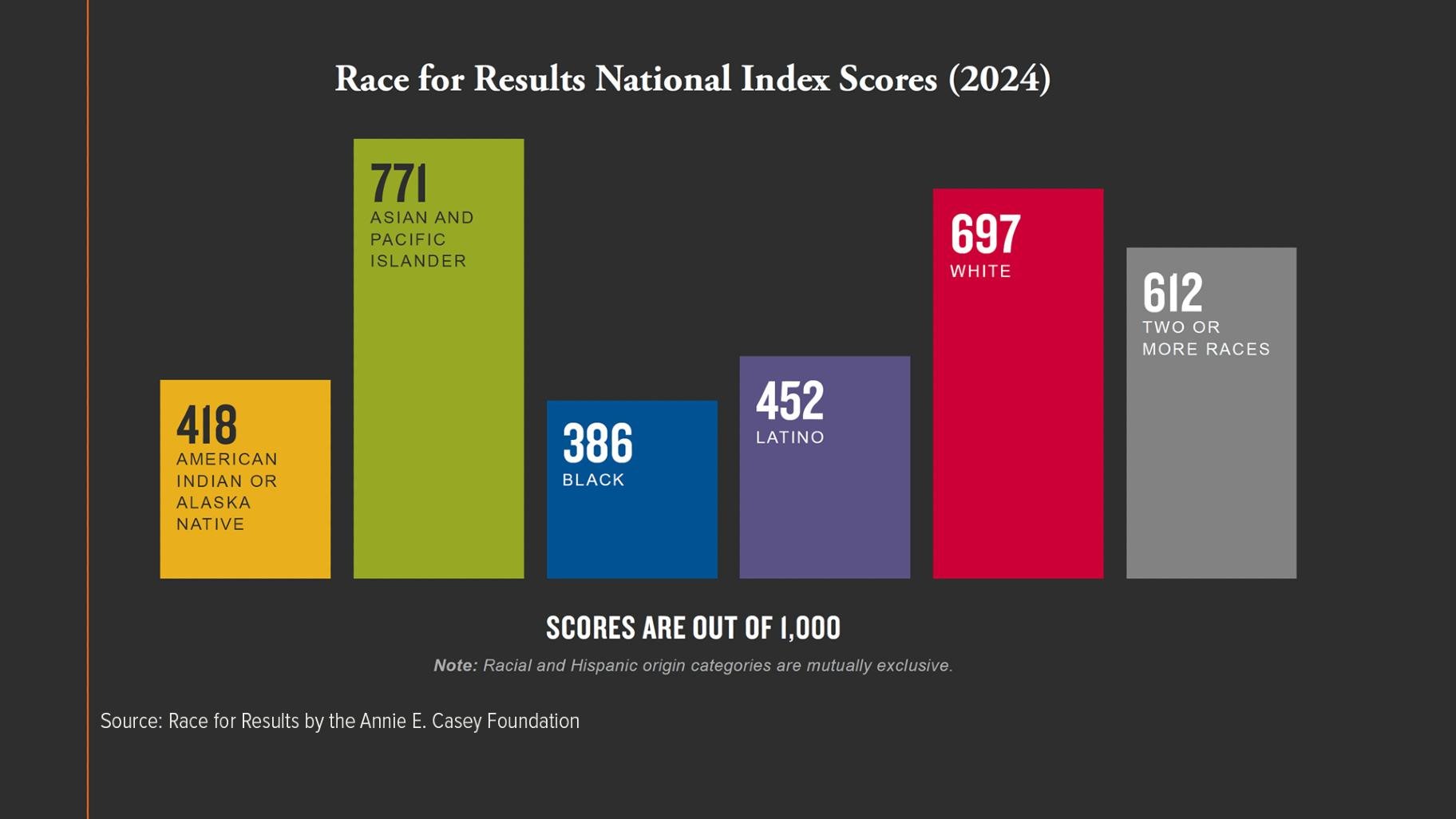

Meanwhile, a new report by the Annie E. Casey Foundation, “Race for Results,” shows the U.S. is making some progress in closing children well-being gaps across race and ethnicity, but disparities still remain.

“Black children are lagging behind,” said Nicole Robinson, CEO of YWCA, an organization that aims to eliminate racism and empower women. “That is sobering as a kid from the South Side of Chicago who benefited from early child care programming, who benefited from safety net programs, it’s tough to hear. … When the federal government expanded the child tax credit, families did the right thing for themselves. They paid off debt, they invested in school supplies and technology and internet access so kids could do homework.”

A graph in the “Race for Results” report shows a large gap between Black children and Asian and White children. (Courtesy of the Annie E. Casey Foundation)

A graph in the “Race for Results” report shows a large gap between Black children and Asian and White children. (Courtesy of the Annie E. Casey Foundation)

A graph in the “Race for Results” report shows a large gap between Black children and Asian and White children. The higher the index score, the greater the likelihood that children in that group are meeting milestones associated with success.

“When I think about this expansion, I get excited because across the board, one of the big factors that’s being measured is poverty rates,” Robinson said. “If families are living in poverty, it makes it really tough to make any progress on any of the other indicators.”

Metropolitan Family Services conducted its own community needs assessment. The organization services about 120,000 people in the Chicago and DuPage County areas.

“It showed that the top issue that our program participants are dealing with is housing, with rent assistance programs as well as job employment,” said Anthony Bryant, government affairs associate with Metropolitan Family Services.

According to Bryant, 98.6% of the families the organization serves are far below or at the Illinois median income of $78,433. Additionally, 84.2% of program participants who provided information fall below 100% of the federal property line.

“We see that as an organization, we need to advocate for a child tax credit because our clients, our program participants are dealing with so many financial burdens,” Byrant said.

Contact Acacia Hernandez: @acacia_rosita | [email protected]