While it might seem like Cook County property owners just paid their property taxes, the first installment of their 2022 bill is available online now and headed to their mailboxes early next month, officials said.

Property owners have until April 3 to pay — a reprieve of approximately a month — after the second installment of property owners’ 2021 tax bills was more than 150 days late amid months of bureaucratic wrangling and finger pointing among Cook County officials.

That gives property owners less than 100 days between tax bill due dates, which is likely to tighten the financial pinch facing those who saw their 2021 bills soar. Among the hardest hit were residents of the Lower West Side community area, which includes Pilsen, whose residents saw their property taxes rise an average of 63%, according to Cook County data.

Typically, the first installment of property taxes is due March 1 and the second installment is due Aug. 1.

Assessor Fritz Kaegi blamed the delay of the second installment of 2021 property tax bills on the Cook County Board of Review for not helping upgrade the assessor’s computer system. But Board of Review Member Larry Rogers Jr. said Kaegi was at fault for not using the old system, as well as the new system, to avoid delays.

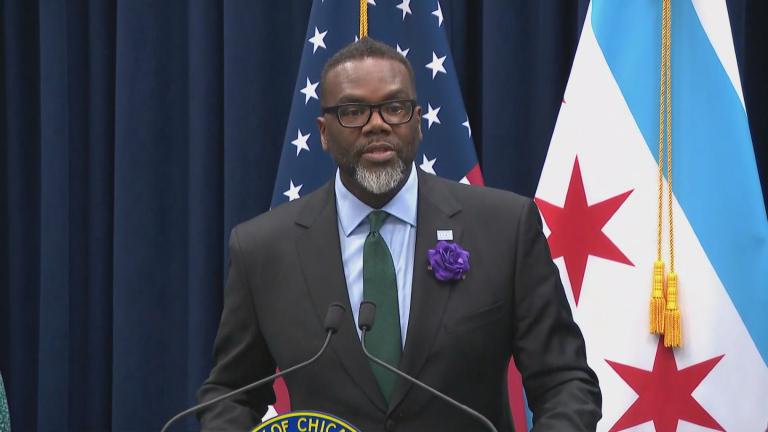

The steep rise in property taxes has been a hot issue in the race for Chicago mayor, with U.S. Rep. Jesús “Chuy” García saying he would use city funds to send grants between $250 and $500 to homeowners struggling to pay their bills. Commercial property owners who saw their bills rise by more than double the city average could get a $1,500 grant, according to García’s plan.

García’s focus on property tax relief won him the endorsement of former Gov. Pat Quinn, who has long crusaded against the state’s reliance on property tax revenues to fund schools and keep its budget out of the red.

A similar property tax rebate plan was proposed by former Mayor Rahm Emanuel and approved by the City Council in 2016, but offered little relief to property owners because of a cumbersome application program.

García acknowledged during a Feb. 9 news conference that tax rebate programs can be complicated to administer and vowed to push for state lawmakers to approve a “long-term solution” and reduce the regressive nature of the state’s tax system.

Contact Heather Cherone: @HeatherCherone | (773) 569-1863 | [email protected]