Illinois has dispersed $750 million to help those who fell behind on rent during the coronavirus pandemic. Additional assistance on the way will bring funding to over $1 billion. Far less – so far $100 million – has gone to homeowners having trouble keeping up with their bills. And it may be months before homeowners receive funding.

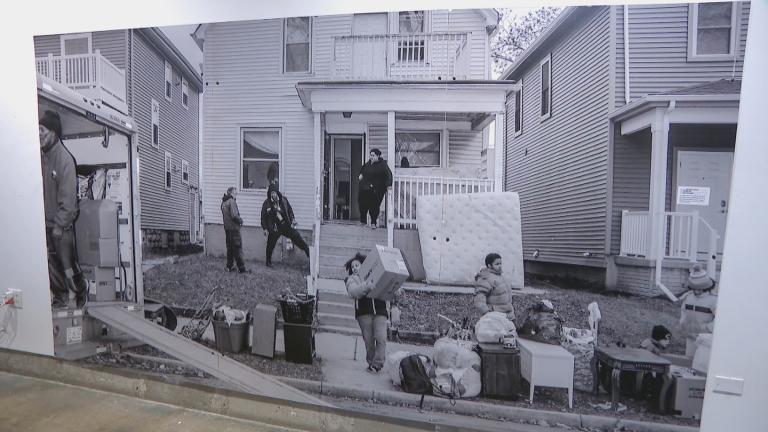

An eviction moratorium and other pandemic cushions helped tenants and homeowners keep roofs over their heads. But the moratorium is no longer in place, meaning legal proceedings that were on pause for much of the pandemic are going forward. Plus, limited federal government protections for homeowners are set to lift in January.

Karla Chrobak, a supervising attorney with CARPLS Legal Aid, a service that provides free legal aid in Cook County, is concerned about an increase in foreclosures.

Chrobak said pre-pandemic, there were already signs that something was brewing. An increasing number of calls came into the hotline with people struggling to pay their mortgages. Then, COVID-19 hit.

“We have lots of people who … got behind in March 2020 and are now facing foreclosure because they’ve gone this whole time without any additional protection, except for eviction from their home,” Chrobak said.

She’s getting calls from frustrated homeowners, desperate for assistance.

One troubled client, who reached out to CARPLS on Tuesday, relied on her 35-year-old daughter’s income to help pay the household bills. The daughter died of COVID-19, leaving the elderly mom and her Social Security checks struggling to keep up with the mortgage.

Early in the pandemic, Illinois helped 10,000 homeowners who’d fallen behind on their mortgages, but that was back in 2020.

This year is set to end without any money for mortgage assistance, even as $250 million is allotted for the cause.

Illinois is still waiting on the federal government’s approval before it can be dispersed, and that’s taking time.

The Community Associations Institute is tracking states’ participation in the Homeowner Assistance Fund.

Head of the Illinois Housing Development Authority Kristin Faust said the feds are working hard and it’s important they survey plans to ensure a prudent use of taxpayer money.

Still, if she had her way, she’d have those dollars flowing already.

Instead, she expects a second round of mortgage relief won’t happen until spring.

“We are a judicial foreclosure state in Illinois. Foreclosures don’t happen rapidly when it’s your own home – this is all about owner-occupied homes. And so we believe that the timing will work for most homeowners. I’m sure there’ll be exceptions, but we do think this timing will work,” Faust said.

Chrobak is less confident.

“The lag time (between now and when Illinois makes more mortgage relief available) is certainly significant and may lead to this kind of influx of foreclosures that I’m so, so nervous about,” Chrobak said. “Something like an infusion of a few tens of thousands of dollars, is something that could save a home. It’s just how quickly is that going to happen before a judge orders a sale of the home? Do we have to wait until a sheriff is at the door? At which point it’s far too late.”

Chrobak and Faust both said it makes sense that rental assistance was prioritized, given the fewer protections in place for renters and the lengthy path to foreclosure.

Even as Illinois waits for the federal signoff of its mortgage assistance plan, both Chrobak and Faust say there are ways to stave off losing one’s home.

First, call the mortgage servicer.

“Most people get something in the mail or something by email about their mortgage payment. The phone number will be right on there. Call them and talk to them about the fact that you’re having trouble making that payment and have that conversation,” Faust said. “A lot of the mortgage companies are being much more … amenable to working on payment plans than they were in the last housing crisis.”

They may offer forbearances which minimizes and puts payments at the back of the bill stack.

Option two: Call one of the trained, skilled housing counselors like CARPLS that offer free legal assistance. Faust stressed that homeowners should rely on a list at IllinoisHousingHelp.org, rather than spend money out of pocket.

“I would really encourage people to reach out to those housing counseling agencies now. Don’t wait until the end. Don’t wait until foreclosure’s going to be filed. Don’t wait until you have a date. The sooner you reach out to your servicer or to the housing counseling agency, the more likely you are to have a really positive resolution,” she said.

Other programs include the Cook County Legal Aid for Housing and Debt’s Early Resolution Program to help resolve eviction, foreclosure, debt, and tax deed issues and the online tool COVID HELP Illinois.

Once a new round of $250 million in mortgage assistance is made available, IHDA estimates 12,000 Illinois households will be eligible for up to $30,000 of aid each.

Struggling renters don’t need to wait.

Illinois and the city of Chicago are each opening up a new round of rental assistance Monday.

To be eligible, tenants must be within 80% of the area’s median income and at least a month behind on rent, starting in June. Priority will be given to those out of work for at least 90 days and those under 50% of an area’s median income.

Those who previously received rental assistance can get more funding, though it must cover new overdue rent;.Chicago residents can apply for funding through both the city and state but cannot receive duplicative grants.

Follow Amanda Vinicky on Twitter: @AmandaVinicky