In November, Illinois voters won’t just be choosing their president and other elected officials. They’ll also be making a choice about how the state taxes income.

But a last-minute lawsuit claims the ballot itself is flawed, and is raising questions about how it may impact retirees.

Even with early voting underway, a lawsuit is seeking to change the language voters are presented with when they decide whether Illinois should change its flat tax system to one that permits income to be taxed at graduated rates.

The lawsuit filed by a group of retirees and the libertarian Illinois Policy Institute on Monday that argues, in part, that a summary provided to voters is misleading.

That explanation reads:

“The proposed amendment grants the State authority to impose higher income tax rates on higher income levels, which is how the federal government and a majority of other states do it. The amendment would remove the portion of the Revenue Article of the Illinois Constitution that is sometimes referred to as the ‘flat tax’ that requires all taxes on income to be at the same rate. The amendment does not itself change tax rates. It gives the State the ability to impose higher tax rates on those with higher income levels and lower income tax rates on those with middle or lower income levels. You are asked to decide whether the proposed amendment should become a part of the Illinois Constitution.”

The IPI’s Austin Berg says that language is not honest.

“It reads like a political ad in favor of the tax,” Berg said. “It gives people the impression that what they’ve voting on is only the power to have lower income rates on lower-income people and higher tax rates on higher-income people. But that’s not what they’re voting on. The constitutional amendment unlocks the constitution to allow for all sorts of different and higher income tax rates on all kinds of income groups. All Illinoisans. All of us.”

The IPI suit argues voters should instead be given the full text of the proposed constitutional amendment.

“The General Assembly shall provide by law for the rate or rates of any tax on or measured by income imposed by the state.”

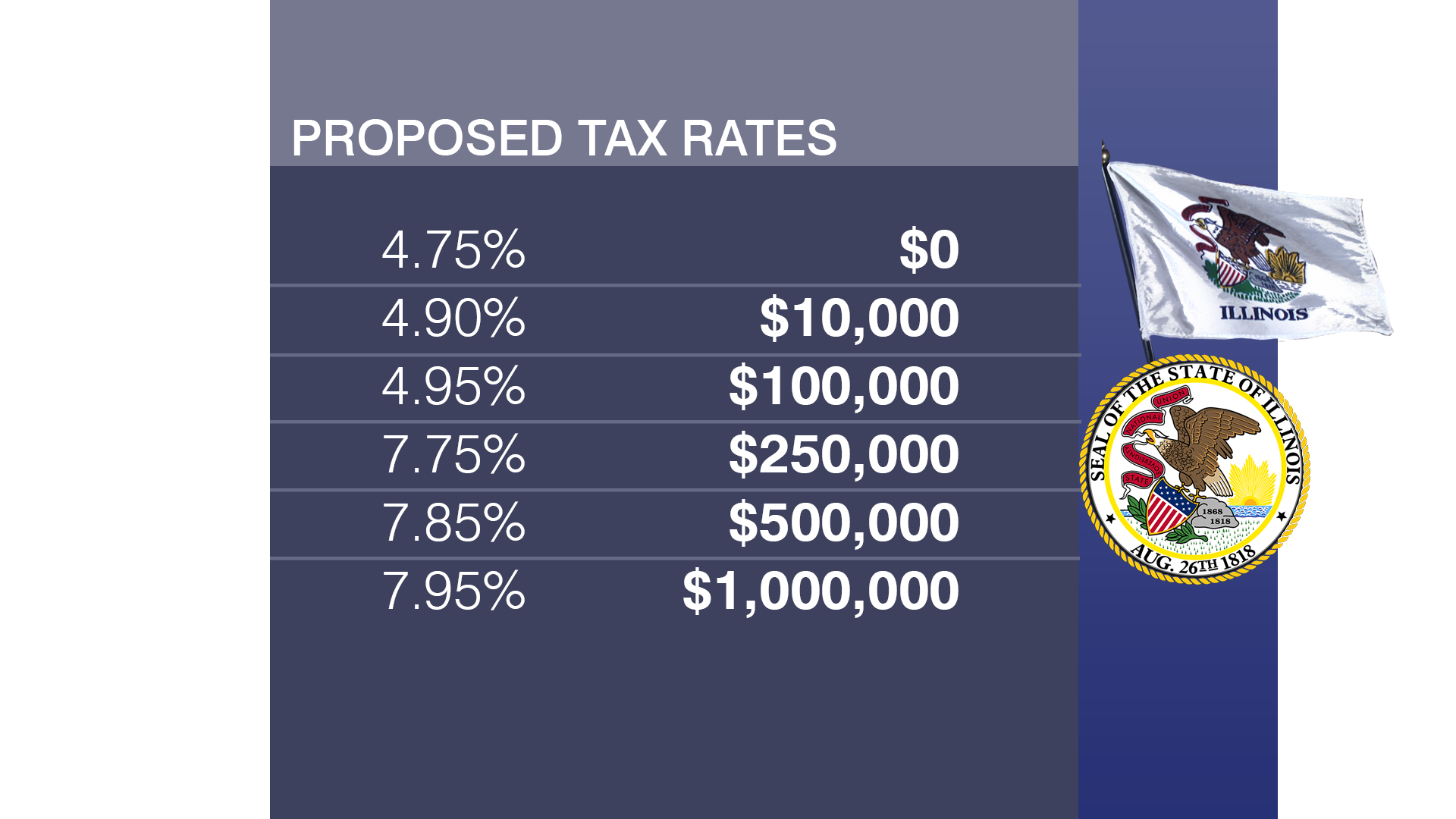

Should voters give the constitutional change their blessing (that requires a majority of those voting in the November election, or three-fifths of voters who take a position on the amendment question) a law is already poised to take effect in 2021. It would mean single filers with incomes of $100,000 and less would pay a lower tax rate while those with incomes above $250,000 would see their marginal tax rate rise above the current 4.95% for individuals.

While passing a law to change tax rates again would likely be a tough political battle, it’s far easier to do than changing the constitution; a law does not carry as much weight as constitutional language.

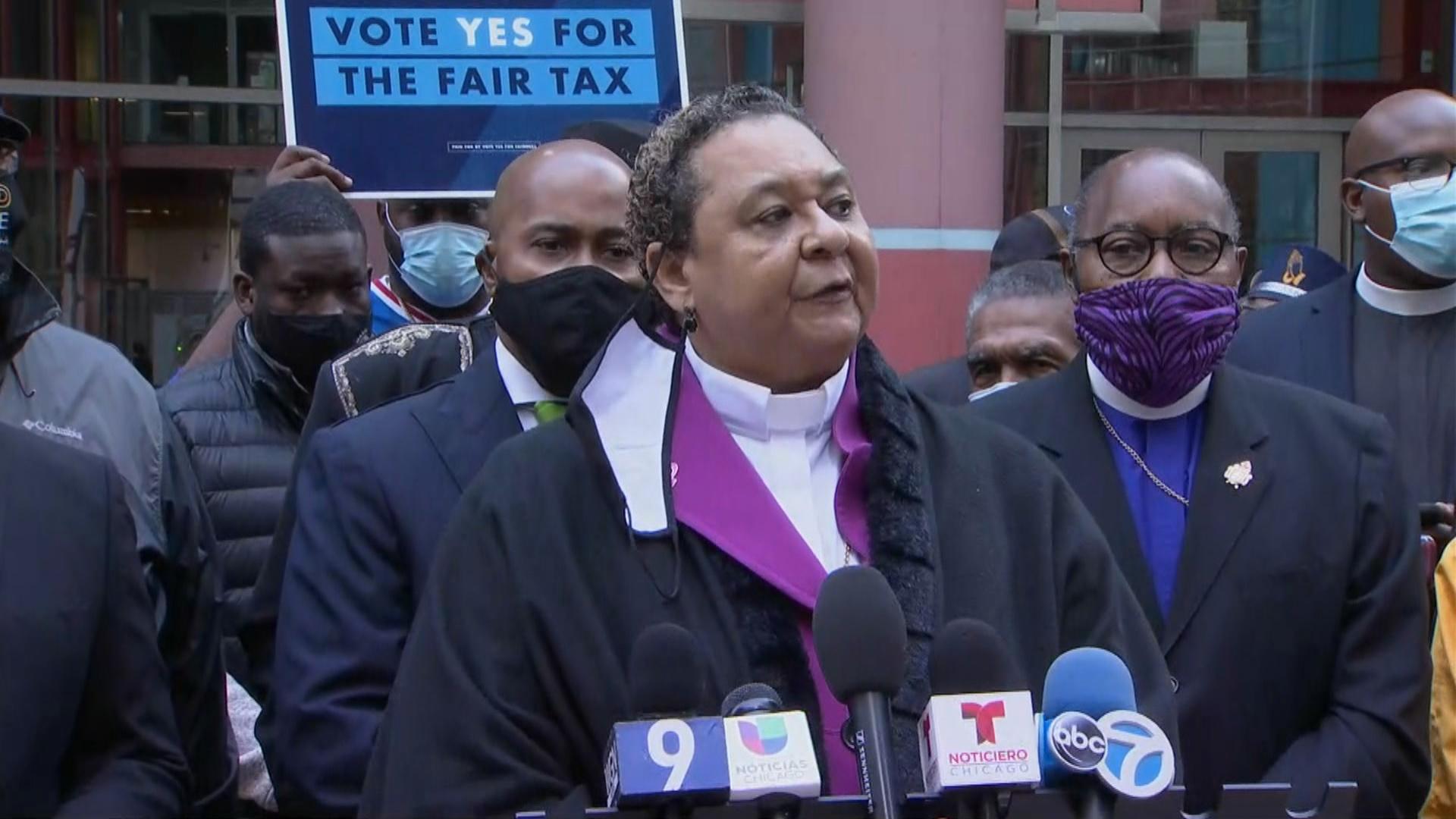

“We teach and preach that to much is given, much is required. And if you are that rich then you should want to help somebody else because that’s what living is all about,” said Bishop Shirley Coleman of the Spiritual Wholistic Ministries of Love & Faith, as Coleman gathered with other religious leaders on Tuesday morning to promote passage of the constitutional amendment.

Advocates, who call the move to a progressive tax a “fair tax,” say that the IPI’s lawsuit is a last-minute, frivolous stunt.

They also take umbrage an underlying component of the lawsuit, in which the IPI and the retirees say the constitutional amendment would “eliminate important structural safeguards that deter legislators in the General Assembly from imposing new taxes on retirement income.”

“This would remove a key protection for Illinois seniors which is the flat tax. That’s one of the biggest political hurdles to taxing retirement income in Illinois,” Berg said.

A political hurdle, Berg said, because it would make clear the way for retirement income to be taxed at graduated versus flat rates.

Bishop Shirley Coleman of the Spiritual Wholistic Ministries of Love & Faith gathers with other religious leaders on Tuesday, Oct. 6, 2020 to promote the “fair tax” amendment. (WTTW News)

Bishop Shirley Coleman of the Spiritual Wholistic Ministries of Love & Faith gathers with other religious leaders on Tuesday, Oct. 6, 2020 to promote the “fair tax” amendment. (WTTW News)

But AARP Illinois State Director Bob Gallo says it’s a false argument.

Illinois does not currently tax retirement income, but there is nothing in the constitution preventing legislators from passing a law to start doing so.

“The myths and lies that are out there about that are obvious of where they’re coming from which are individuals who don’t want to pay their fair share,” he said. “The state could have raised or taxed retirement income all along and they have floated that trial balloon in the past and AARP stopped it in its tracks.”

Gallo said AARP will do the same should anyone instigate discussions about taxing retirement.

He said a graduated tax will help seniors, by helping to get the state on sounder fiscal footing after in recent years having social services that support vulnerable populations get gutted for lack of funding.

“This is going to help seniors and people in the middle class, to make sure that vital services that the state provides all across the state, not just in one part of the state, stay intact and continue to grow so people can live their lives comfortably,” Gallo said. “What this does is, it’s going to help the most vulnerable.”

The AARP, Jane Addams Seniors in Action and the Illinois Alliance for Retired Americans will hold a press conference Wednesday to discuss what the groups classify as misinformation about the graduated income tax leading to a retirement tax.

Seniors vote more than any other age group, and surveys have frequently shown seniors are opposed to Illinois taxing retirement income despite recommendations from fiscal watchdog groups like the non-partisan Civic Federation to eliminate that tax exemption on retirement income, particularly retirement income above a certain dollar threshold.

Follow Amanda Vinicky on Twitter: @AmandaVinicky