There’s a heated race on the November ballot in Illinois, and it doesn’t involve any candidates.

Illinoisans will be asked whether or not to change the state’s income tax system from a flat tax to a graduated tax, where those with higher incomes pay more than those with lower incomes.

The mailers, TV commercials and phone calls are coming at residents from groups in favor of and opposition to the so-called fair tax.

It’s perhaps Gov. J.B. Pritzker’s number one initiative – a ballot measure passed by Democrats in the legislature that asks voters whether they want to change the state’s constitution.

The specific language that voters will see reads:

The proposed amendment grants the State authority to impose higher income tax rates on higher income levels, which is how the federal government and a majority of other states do it. The amendment would remove the portion of the Revenue Article of the Illinois Constitution that is sometimes referred to as the “flat tax,” that requires all taxes on income to be at the same rate. The amendment does not itself change tax rates. It gives the State the ability to impose higher tax rates on those with higher income levels and lower income tax rates on those with middle or lower income levels. You are asked to decide whether the proposed amendment should become a part of the Illinois Constitution.

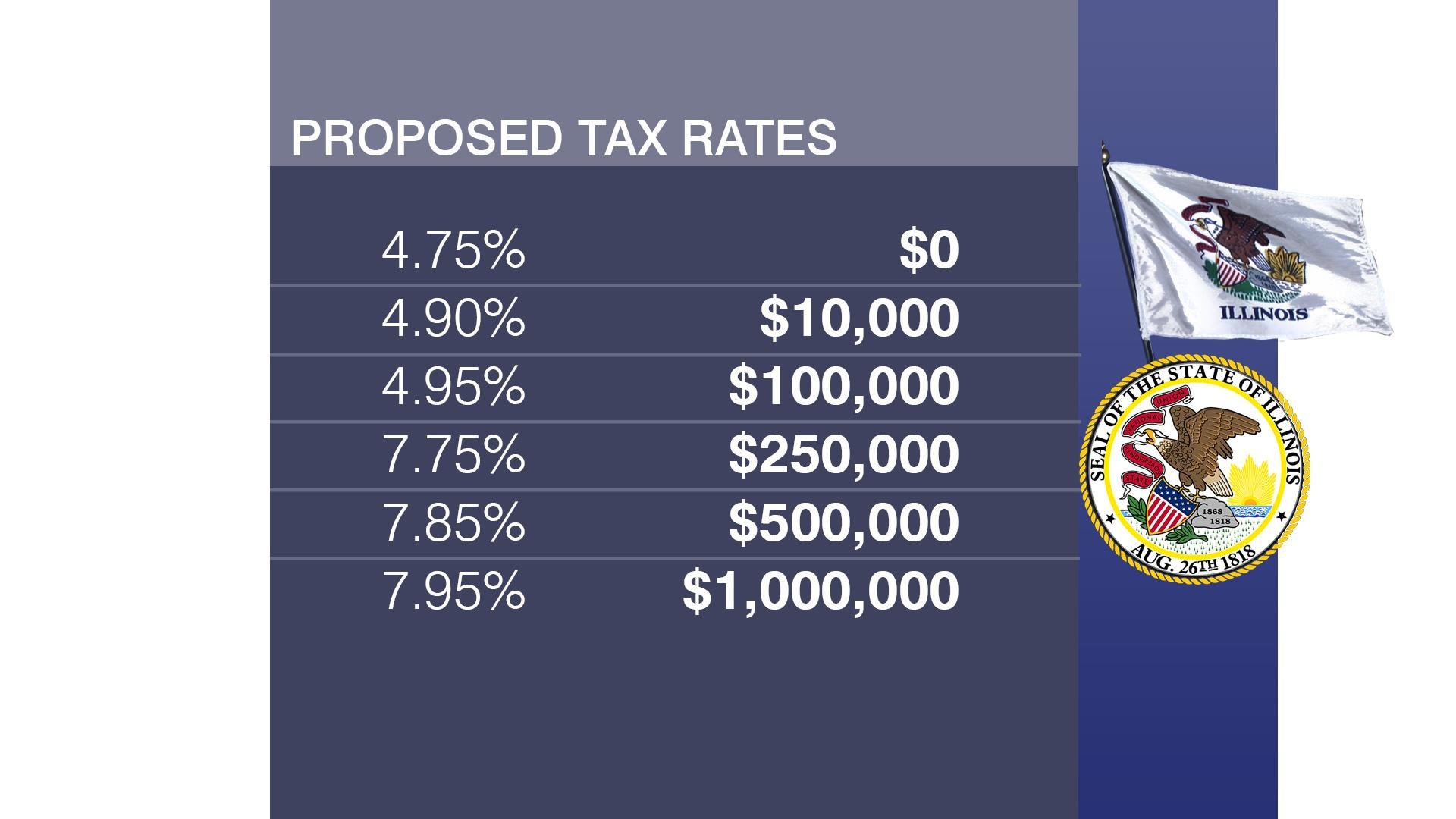

The rates would go from a flat tax of 4.95% to a graduated structure. The following rates have been proposed:

The catch for millionaires is that all income would be taxed at that 7.95% rate — not just the interval. Proponents, with backing from the governor, say it’s the fairest way to get Illinois some badly needed revenue.

“Illinois is in a fiscal hole and we need revenue to get out of it, and we believe that revenue should come from those who have it and afford it, and take the burden off lower and middle income Illinoisans,” said Quentin Fulks, executive director of the political committee Vote Yes For Fairness.

Opponents believe the amendment gives lawmakers a blank check to come back and raise taxes more in the future.

“They wanted us to trust them, and on the tax hike that they’re proposing, we won’t be voting on those tax rates,” said Lissa Druss, spokesperson for the political committee Stop the Proposed Tax Hike Amendment. “They’re not baked into the constitutional amendment. The only thing baked into the constitutional amendment is giving Springfield more power, asking us to trust them.”

A billboard in Chicago promotes voting in favor of the so-called fair tax in the November election. (WTTW News)

A billboard in Chicago promotes voting in favor of the so-called fair tax in the November election. (WTTW News)

Vote Yes For Fairness is a committee spun out of a 501c4 group called Think Big Illinois. It’s funded to the tune of $51 million entirely from Pritzker himself.

The Coalition to Stop the Proposed Tax Hike Amendment gets the bulk of its funding through a $20 million donation from Illinois wealthiest resident: the founder of Citadel, Ken Griffin.

One of that group’s other concerns is how the new structure would hurt businesses that claim pass-through income and are taxed at the individual rate instead of the corporate rate.

“We’re talking about employers, and we’re talking about a state that is seeing people flee by the minute,” Druss said. “Higher taxes are just another recipe for employers to leave. And that’s going to affect bottom line, wages, and jobs in our state, and we can’t have that right now.”

But proponents say the tax actually helps small business, especially those whose earnings are volatile from year to year.

“Say for instance that a farmer has a very good year, they make $280,000, but then they have a terrible year, something out of their control, and they make $40,000,” said Fulks. “This will protect them under both circumstances. If they made over $250,000, they’d have to pay a percentage at a higher tax rate on income over $250,000, but also if they made less then that, it would protect them. The majority of businesses in Illinois make less than $250,000. This is not going to hurt small businesses.”

It’s important to note that the amendment would not allow for the taxation of retirement income. Also, if the state legislature so chooses, it could raise taxes at a future date, but rates have to be within the progressive structure in which higher incomes are taxed at higher rates than lower or middle incomes.

Follow Paris Schutz on Twitter: @paschutz

More voter resources: 2020 Voter Guide to the General Election

More voter resources: 2020 Voter Guide to the General Election