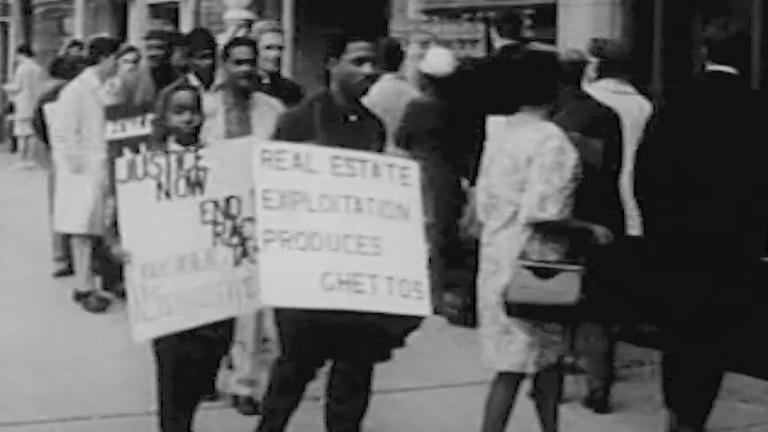

Private investors are exploiting an “arcane” Illinois law to profit from the property tax debt owed on thousands of properties, fueling disinvestment in communities that are home to Black and Latino residents, according to a new study from the Cook County Treasurer’s office.

Thanks to a “little-known loophole,” hedge funds, private equity firms and real estate investors have “siphoned” approximately $280 million from schools, parks, libraries, fire departments and other government agencies between September 2015 and September 2022 in accordance with a law passed in 1872, according to the study, authored by Todd Lighty, deputy director of research affairs for the treasurer’s office and a former Chicago Tribune reporter.

The study is the latest from Pappas’ office to take aim at efforts by Cook County officials to breathe new life into distressed properties saddled with mountains of tax debt.

Annually, the Cook County Treasurer’s office auctions off the unpaid property taxes from the previous year in an effort to recoup some of the lost revenue for taxing agencies, like school districts. Once that debt is purchased, and a lien is placed on the property, the interest on those unpaid taxes grows at a 12% interest rate, making it very difficult for property owners to repay that debt and regain complete ownership of their home, according to the study.

That can result in profits of 54% in just three years, if the owner does not pay off the debt in full, according to the study.

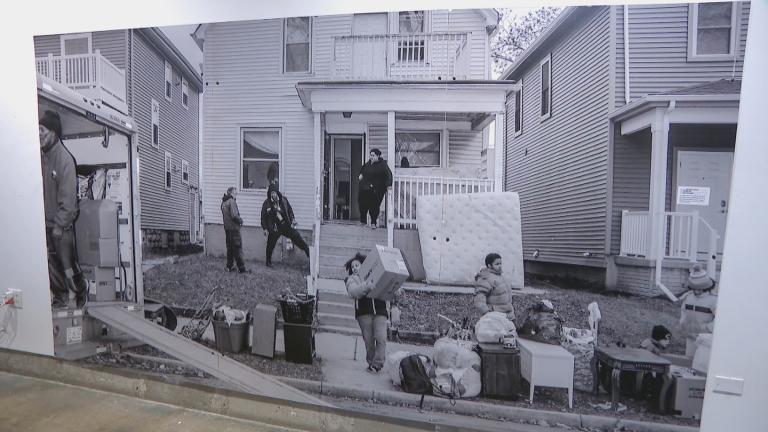

But few of these investment companies want to own these properties, many of which are in the economically distressed suburbs south of the city, as well as on Chicago’s South and West sides. Instead, the companies use a provision of the law that allows them to ask a judge to invalidate the sale, claiming an error made the sale invalid.

In several cases examined by the study, clerical errors — including a misspelled street name — were enough to cancel the sale, which allows the tax lien holders to wash their hands of the property, with their profits intact. That drains property tax revenue from governments, deepening disinvestment and poverty, according to the study.

That makes Illinois “like no other state in the country,” where the law “allows tax buyers to easily and quickly undo a tax deal for trivial reasons, often getting all of their money back, including interest, fees and court costs,” according to the study.

That can boost the bottom line for investment firms looking to capitalize on property owners’ debt — and hurt governments struggling to pay for essential services, according to the study.

“These tax buyers — hedge funds, private equity and other real estate investors have profited at the expense of poor, predominately Black and Latino communities,” the study concludes.

The law must be changed to require a “material” error if a sale to a tax buyer is to be canceled, the study concludes.

“Without change, financially struggling Black and Latino communities will continue to lose much-needed revenue,” according to the study.

Contact Heather Cherone: @HeatherCherone | (773) 569-1863 | [email protected]